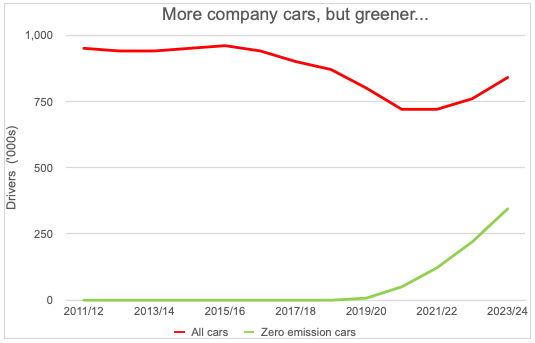

New data from HMRC reveals a resurgence in company car ownership driven not by nostalgia, but by strategic tax incentives and the rise of electric vehicles. For business owners and senior executives exploring tax-efficient remuneration, this trend offers both opportunity and caution.

Source: HMRC

Between 2015/16 and 2020/21, company car ownership declined by 25%. But recent figures show a clear reversal, largely due to the rapid uptake of electric vehicles:

- In 2018/19, fewer than 0.5% of company cars were zero-emission.

- By 2023/24, that figure had surged to around 40%.

- Over the same period, diesel cars dropped from over 66% of the fleet to just 12%.

Tax Policy as a Catalyst

This shift isn’t driven by environmental sentiment, it’s a textbook case of tax policy shaping behaviour:

- Optional Remuneration Arrangement (OpRA)

Introduced in April 2017, OpRA changed how salary sacrifice schemes were taxed. For most cars, the benefit-in-kind (BIK) tax was based on the car’s value rather than the salary foregone. However, low-emission vehicles (under 75g/km CO₂) were carved out, creating a niche incentive.

- Zero-Emission Incentives

In 2020/21, the BIK rate for electric cars dropped from 16% to 0%, rising gradually to 2% by 2022/23 and 3% in 2025/26. Petrol cars, by contrast, saw only marginal increases. These incentives made electric company cars highly attractive under salary sacrifice arrangements.

Looking Ahead: Rising Charges and Strategic Planning

While uptake has soared, the tax advantage is narrowing. The BIK rate for zero-emission cars is set to rise to 9% by 2029/30, triple the current level. The total taxable value of company cars has already dropped from £5.43 billion in 2019/20 to £3.27 billion in 2023/24.

For directors and business owners considering salary sacrifice or reviewing executive benefits, electric company cars may still offer value but the window for optimal tax efficiency is narrowing. A tailored review of remuneration structures, fleet policies, and benefit-in-kind exposure is increasingly important.

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax advice.

15th August 2025