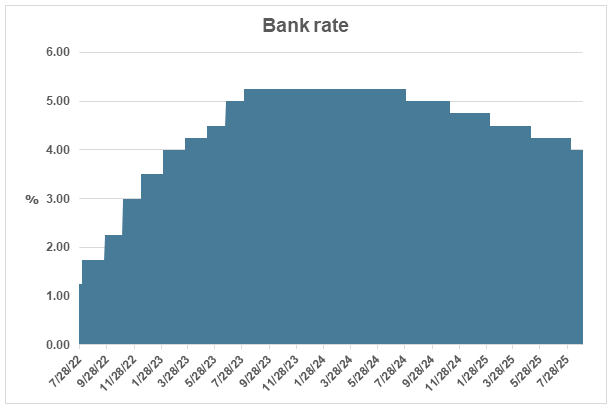

August’s 0.25% interest rate cut wasn’t a straightforward decision, and it could shape how future rate changes unfold

Source: Bank of England

Since gaining independence in 1997, the Bank of England has set interest rates through its Monetary Policy Committee (MPC), a nine-member panel made up of five internal and four external experts. With an odd number of members, a majority vote is usually guaranteed. But on 7 August 2025, that assumption was tested.

Here’s how the first vote played out:

- Four members voted to keep rates unchanged.

- Four members supported a 0.25% cut.

- One member pushed for a 0.5% cut.

With no clear majority, a second vote was held, this time focused solely on the 0.25% cut. The result: 5–4 in favour, lowering the Bank Rate to 4%.

Interestingly, 4% also featured in the Bank’s revised inflation forecast. The MPC now expects consumer price inflation to peak at 4% in September 2025. Cutting rates while inflation is rising is unusual, but the Bank is taking a longer-term view. It anticipates inflation will ease back toward its 2% target, attributing the current spike to energy, food, and regulated price increases.

The rate cut also reflects concern over sluggish economic growth, just 0.3% in Q2. Lower rates may help stimulate activity, even as inflation temporarily climbs.

What’s Next?

The MPC remains cautious, stating that monetary policy is “not on a pre-set path” and will respond to evolving data. Many expect the Committee to wait for the autumn Budget before considering further changes.

In the meantime, medium- and long-term government bond yields have reached levels not seen in over 15 years, offering potentially attractive opportunities for income-focused investors.

Please note: the value of investments and any income from them can go down as well as up, and you may not get back the full amount invested.

26th September 2025